Proliferation of Index Funds in India

Index funds offer several benefits to investors who want to start investing in the stock market. While index funds are good for first time investors with no experience or skill in picking their stocks, they are also useful for seasoned investors to diversify their holdings and enter new markets. Index investing also does not need...

Will the Current Market Recovery Last?

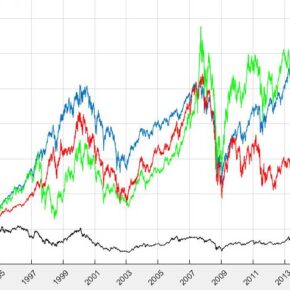

The Indian stock markets have recovered from their March lows very quickly. Indian stock market currently one of the best performing in the world. Will the market recovery last? More importantly, is it the right time for the investors to jump in and pour money into the markets? The performance of the stock market does...

The Best Time to Invest in Equities

Investors should know the best time to buy stocks. Indeed, they should buy stocks when they are available at a cheaper (or reasonable) price in the market and sell them when their prices increase later. But what is the time when stocks are available for a reasonable price? The value of almost all equities falls...

Should You Buy All Your Financial Products from Banks?

Banks have now become financial supermarkets that sell all kinds of financial products. Under the ‘Universal Banking’ system, banks sell insurance, mutual funds, online trading services, etc. Many customers are preferring to buy all the financial services needed by them from a single bank where they have an account. The main reason for this preference...

Your Guide to Select a Suitable Credit Card

It is often difficult to make a choice when there are a plethora of options available. Is n’t it? Selecting the most suitable credit card for your needs can be a challenging task as there are multiple offerings in the market. Should you go for a premium credit card with free offerings and annual fees?...

My Experience With Transferring Mutual Fund Units in Demat Form

I recently wanted to close one of my Savings Bank Accounts I had with a private bank. When I approached the bank, I was informed that I need to close the linked Demat account before the Savings Account could be closed. And I was also informed that I could not close the Demat account until...

Buying A Home on Loan Only for Saving on Taxes is Not a Good Idea

Buying a home is a major financial decision that every person takes in her life. A home is treated as a major investment. For many middle-class families in India and other developing countries, owning a home is a matter of prestige. Easy access to credit made many people around the world to buy a home...

What Should You Do During this Market Correction?

The Indian Stock market has been falling for the past few weeks. From a peak of 36,283 reached on January 29, 2018; the Sensex fell by 10.2 percent. Given the high valuations of stocks which are not backed up by corporate earnings, many analysts opine that the market correction is overdue. Markets may fall further...

How to Save on Your Education Costs and Avoid Student Debt

Education helps a person to grow in life by imparting him with the requisite skills and knowledge. The importance of education makes young people spend a lot of money on getting a degree from a good university. The cost of education is rising all over the world. Students in developed countries like USA shell out...

Five Tips to Save Yourself from Falling into a Credit Card Debt Trap

Credit cards make life easy for their users. They make it very convenient to pay for purchases without the need to carry cash. The amount spent on making purchases using the credit cards can be repaid after a free credit period offered by the credit card providers. When not utilized properly, credit cards could result in...